Have you ever felt like quitting your government job?

We all know that we will be rewarded with a great pension once we reach minimum retirement age (MRA). But what if we never make it there?

Perhaps a golden opportunity comes up in the private sector. Or maybe you’re like me and hoping to reach financial independence and retire early. Maybe you’re forced to leave because of a RIF or directed reassignment.

In this article, I break down everything you need to know about FERS deferred retirement. A “deferred retirement” is what happens to your FERS pension if you leave government before your retirement age. Buckle your seatbelts because we’re going on a fully guided tour of everything you could ever want to know about FERS deferred retirement.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is FERS deferred retirement?

- How is FERS deferred retirement calculated?

- When to collect FERS deferred retirement?

- FERS deferred retirement and TSP

- FERS deferred retirement and FEHB

- Inflation- the big downside of a deferred retirement

- How I look at deferred retirement

- How Melanie from PartnersInFire Looks at Deferred Retirement

- Summary- what else is there to know about FERS deferred retirement?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is FERS deferred retirement?

If you leave government service before you reach MRA, your pension is “deferred” until you are old enough to claim it.

To receive a deferred pension, you need to be vested in the FERS retirement system. Vesting starts at 5 years of government service. However, you unlock numerous benefits the longer you remain in government service. While my previous post covered this in great detail, here is a quick summary:

- 5 years:

- Benefits available at age 62.

- 10 years:

- Benefits available at age 62 OR

- Reduced benefits available at age 57

- 20 years:

- Benefits available at age 60 OR

- Reduced benefits available at age 57

How is FERS deferred retirement calculated?

So- how much of your pension benefit do you get to keep? The FERS deferred retirement annuity formula is the same as the full FERS pension:

(years of service) × 0.01 × (average of 3 highest yearly salaries)

Or in simple terms, you get approximately 1% of your final salary for each year of federal service you have. (Assuming you didn’t quit after a big promotion!)

If you want to begin collecting your deferred retirement before age 62 (or 60 with 20 years) the government will reduce your benefits. They apply a reduction of 5% for every year under age 62 you are when you begin collecting benefits. In other words, if you collect your retirement benefit as soon as you are able to at age 57, you’d receive a 25% reduction in benefits.

When to collect FERS deferred retirement?

Confused by the previous paragraph?

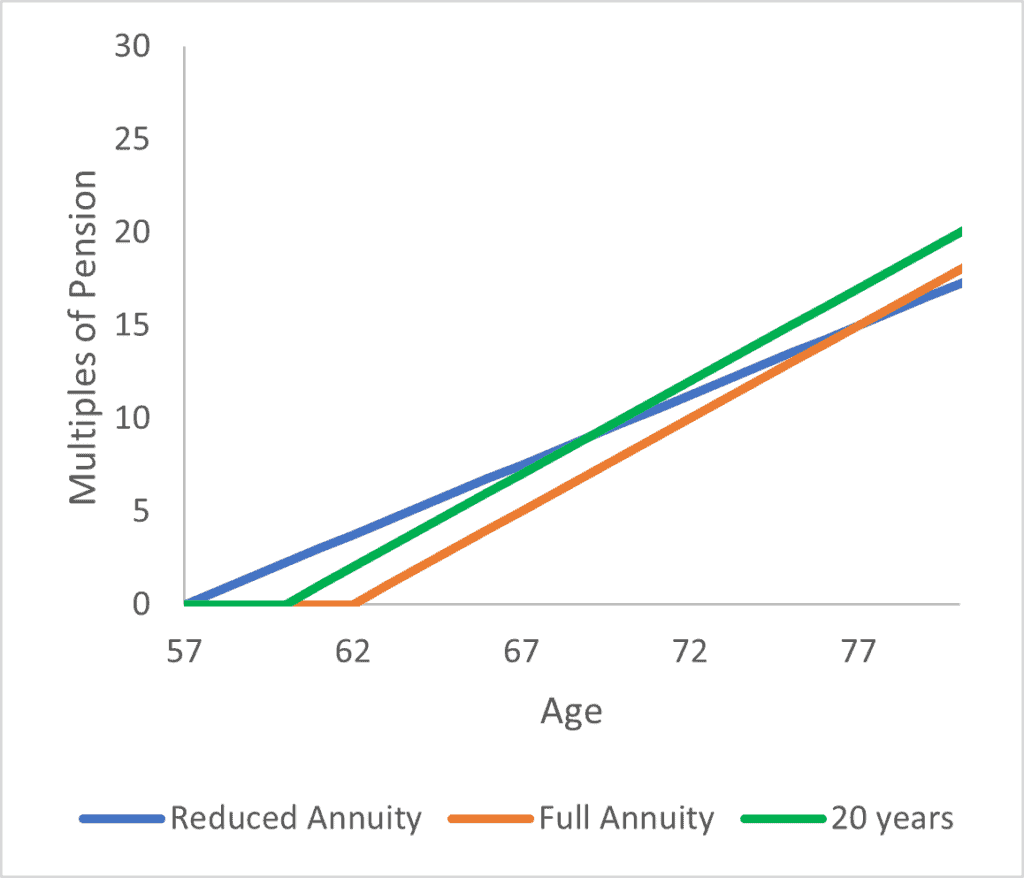

I made a graph to show how your retirement benefits depend on when you collect your FERS deferred retirement.

If you start collecting your deferred retirement at age 57, you will have earned a significant amount of money before you even turn 62. However, if you wait until 62, you’ll earn more per year (see figure). It turns out that at age 77 is the break-even point for collecting at age 57.

If you live longer than 77, you will have collected more money over your lifetime by waiting to 62. If you pass away on or before age 77, you’re better off if you start collecting at 57 from a strictly monetary basis. In case you’re wondering, the break even age remains 77 no matter what age you start collecting between 57 and 61 years old.

What if you’ve worked for 20 years? I’ve got you covered there as well. In that case, you break even at age 69.

FERS deferred retirement and TSP

Federal employees receive both a defined contribution retirement benefits (TSP) and defined benefit retirement (FERS). These benefits are separate.

Taking a deferred retirement will not affect your TSP. Once you separate from the federal government, you have many options on how and when to withdraw money from your TSP. If you took a deferred retirement as part of an early retirement strategy, you might want to consider doing a Roth IRA ladder with your TSP contributions to access them before age 59.5.

However, once you leave government service you will no longer be able to contribute to your TSP.

FERS deferred retirement and FEHB

One of the best benefits of working for the federal government is that you get to keep your health insurance benefits in retirement. Unfortunately, if you take a deferred retirement, you lose access to your health insurance benefits (FEHB).

Not only do you lose out on FEHB with a deferred retirement, you also lose out on a FERS supplement. I calculated that I would lose at least $1,000,000 by retiring 1 day before my MRA.

Inflation- the big downside of a deferred retirement

Deferred retirement comes with good news and bad news. The good news is that you get a pension! The bad news is that inflation slowly erodes the value of your pension.

If you continue to work until you retire, you will inevitably get cost of living adjustments. While the government COLA has not kept up with inflation, it is better than no pay increases.

Based on my current progress towards financial independence, I think I’ll be financially independent by the time I am 40. At that time I think my deferred pension would be worth about $22,000 per year. If I wait until I’m 62 to touch the pension, it will still be worth $22,000 per year. However, at an inflation rate of 2%, $22,000 will be only worth about $14,000 in today’s dollars.

How I look at deferred retirement

As I alluded to in my last paragraph, I’ll be financially independent well before retirement age. Therefore, I’ve spent a lot of time thinking about deferred retirement. Here are some of my current thoughts.

Maximizing benefits

No matter what kind of retirement planning you do, the goal is to not run out of money before you die. Of course you don’t know when you’re going to die. If you did, you could make an efficient plan for drawing down your assets.

If I take a FERS deferred retirement, I’ll need to choose a withdrawal start date. I had 2 uncles die at 76 or younger, and all of my mom siblings have had a heart attack or stroke by the time they were in their mid 70’s. My dad’s sister died at 83 of COPD (lifelong smoker). As my parent’s generation of the family passes away, I get a scatter plot of my expected life expectancy. It doesn’t look great.

I’m in great shape and medicine is continuously advancing. But I’m also fighting some sub-optimal genetics. While I need to make sure I’ll have some money if I live until 90+, I don’t envision myself living much past 80.

From that standpoint, I don’t think I’d be leaving much money on the table if I started collecting it at 57. On the other hand, will I even need the money?

Ability to spend my pension

My current plans are to take a deferred retirement once I reach a comfortable level of financial independence. Therefore, by definition, I’ll be able to live off my investments and won’t need to earn another penny.

I look at my pension as a bonus and don’t include my pension in my financial independence calculations.

Even while I may leave money on the table, I currently want to collect the deferred retirement at MRA. That way, I’m getting this extra, bonus money, when I’m the youngest and have the most energy to enjoy spending it. Assuming we achieve FI, then the pension is superfluous to sustaining our living and in some ways, is “fun money”. Because we don’t need it, I don’t see any reason to hoard my pension just to maximize my returns.

Social Security

Social security is another annuity that will hopefully exist when I reach 62. Like the FERS pension, social security benefits increase the longer you delay taking them. Most financial planners suggest waiting until the latest possible date to begin receiving social security to maximize the monthly benefit.

Knowing that I could collect both the FERS deferred retirement pension and Social Security, (and hopefully not need either), I could see drawing the FERS pension as early as possible but waiting to withdrawal social security. That way, if I die young, I’ll have gotten a better deal on the FERS pension and if I don’t, I’ll have a larger social security check as a backstop.

Again, I’m not giving financial advice. Nor am I advocating for this strategy of accessing a deferred retirement and social security. These are just my thoughts as I approach financial independence.

One more year syndrome

When I was writing this post and thinking about financial independence, it’s easy to get sucked into a “one more year” analysis.

The soonest I calculate we will hit our FI milestone is my 40th birthday.

But then I thought, I should at least work until I reached pay period 26. All my banked annual leave would pay out in the following January. I could get a tax efficient boost in my first year of financial independence. And my deferred retirement would be even bigger. So I probably wouldn’t leave in Summer of 2022, but more like January of 2023.

But then I thought about it even more. In November of 2020 I was promoted to a higher grade. Would I really quit before I reached 3 years at my highest grade in November 2023? If I’m staying until November 2023, I should definitely wait until January 2024 for the annual leave payout.

And if I were going to stick around until I reached 3 years at my new grade, maybe I should stick around until I reached 20 years of FERS coverage in June of 2025?

If I stuck with this thought pattern I might as well stick around until my MRA.

Summary

In short, I’m a lucky guy. I have the option to retire early. As I get closer to reaching financial independence, I will have to weigh various options about when to collect my deferred retirement.

How Melanie from PartnersInFire Looks at Deferred Retirement

While I spent a lot of time talking about how I viewed deferred retirement, I thought it would be cool to share another voice. Melanie of PartnersInFire wrote a guest post on my blog shortly after I had started blogging. Since her post was focused on her desire to take a deferred retirement, I thought I’d combine excerpts of it into this post (with a 301 redirect from the old post).

Melanie’s thoughts on FERS deferred retirement

Because I’ve been with the government for so long already, I have three options when it comes to retirement. I can stick with the government for another 30 years (which sound miserable), I can cash out (which comes with its own set of risks and problems), or I can take a deferred retirement.

I’m choosing the deferred retirement option because my main goal is to not be in poverty when I’m a senior. My retirement planning is a three-legged stool which includes a thrift savings plan, my pension, and social security. All three have different levels of risk and rewards, which is why I want to keep them separate. Diversification for the win!

Thrift Savings Plan

The first leg is my thrift savings plan. I have a pretty good chunk of change invested already, and even if I don’t invest another dime, I will have over 700K by the time I’m 62 (assuming a 7% year over year growth rate). That means I’ll be able to withdraw about $2300 per month, which is more than enough to pay for all of my current expenses.

I’m not planning on not investing another dime though. I’m investing an addition six thousand per year, and I’m getting an employee match on top of that. The government matches you dollar for dollar for the first 3% that you put in, and fifty cents per dollar for the next 2%. It also puts an additional 1% in no matter what (so even people who opt to not contribute for some reason get that 1%). In total, the government matches 5% of my pay, so they are putting an additional 4800 or so per year into my TSP. That means I’m contributing a little over ten-grand extra per year for every year that I continue working.

The thrift savings plan does have a vesting requirement. You have to work for the government for three years in order to keep any match that they provide. I’ve worked for the government for much, much longer than three years, so I don’t have to worry about being vested

Pension

Unfortunately, the market is insane, and there is no guarantee that I will get the 7% per year or that there won’t be bad years when I need it the most. Which brings me to leg number two – the much safer pension. My goal is to receive a FERS deferred retirement pension of 1Kper month, which will help ensure I beat inflation when the market is stable, and give me a cushion for the years when it is not.

Let’s do some fun math to see if I’m going to achieve my goal of 1K per month! I’m going to use estimates and rounded numbers here, so as not to disclose my exact income or GS level (though I’m sure some of you sleuths will probably be able to figure it out!).

My average salary for my top three years is about $97000, and I’ve currently worked for the government for 12 years. So, to find out what my pension would be if I retired now, we would multiply:

97,000 x 12 x .01 = 11,640

That would net me about $970 per month in pension benefits, which is a tad bit shy of my goal. It’s a good thing I’m not retiring today! I’m actually not planning on quitting my job for another two years, so let’s see where that gets me.

97,000 x 14 x .01 = 13,580

Waiting that extra two years would net me $1130 per month in pension benefits! Not too shabby for two extra years I was planning on working anyway.

I do have the option to cash my pension out if I leave the government before my minimum retirement age, but I don’t want to do that. I’d prefer to take the deferred retirement benefit. I already have a major leg of my retirement plan invested, and I want diversity. The pension is a guaranteed, stable 1K per month that won’t change with the market.

Of course, I realize that crazy things can happen – nothing is guaranteed. But I’m making my plan based on things that are likely to happen. I doubt that the government will collapse in the next 30 years (and if it does, we all have way bigger problems than losing a pension!) and the federal government’s pension system is pretty solvent at the moment, so there’s not a huge risk of it getting destroyed. That risk is always present though, which is why my pension isn’t my only leg.

Social Security

The third leg is social security. I know there’s a lot of fear mongering about social security disappearing, but I don’t think the situation is a dire as they say. I may not get the full benefit, but I’m sure I’ll get something. According to this calculator, if I stop working in two years, at age 62 I’ll be able to collect $1155 per month in social security.

This assumes that I will do absolutely nothing when I quit my job though, and that’s not going to be the case. I do plan on working in some capacity. Perhaps I will work part time at a job I love, or perhaps my blog will actually take off and start earning me real money. But either way, it’s nice to know that even if I don’t do anything, I won’t be destitute when I’m older.

Total retirement income

If everything goes according to plan, I’ll make $4,585 per month in retirement income from these three legs. That’s not too shabby for quitting the big job before 40! I just have to figure out how to make it from 40 to 62 – but that’s a different part of the journey.

Other retirement Income

These three legs are just the things that I am confident that I will have. I’m not taking any side hustles, other passive income (rental properties, non-retirement investments, etc.), or part time jobs into consideration. I like to be busy, so I’m sure I will be up to something!

I know that 30 years is a long time from now, and nothing ever goes according to plan, but I’m not going to live my life in fear. I’m not going to be miserable for the next 30 years because something might go wrong with one of these legs. I’ll do my best to plan for the future (and I think I have!) but I’m also going to live my life my way now. I think that’s the best that any of us can do.

Summary- what else is there to know about FERS deferred retirement?

Hopefully you learned a ton about FERS deferred retirement. Not only did I try to explain how FERS deferred retirement works but I also gave a couple of case studies. Hopefully these two examples from federal employees can help you plan out your own FERS deferred retirement if that’s something you’re considering.

Did you enjoy this article? If so, share it with every federal employee you know. Got a controversial hot take on my article? Post it to social media and tag me! (Comments are disabled to encourage social media sharing and discussions.)

Get Gov Worker’s top 4 tips for federal employees!

![Had Enough? Federal Government Early Retirement [Ultimate How To Guide]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2021/05/early-retirement-federal-employees.jpg)