Chances are that you are not invested in the TSP F Fund.

According to the TSP Board, it is the least utilized fund within the TSP.

Why is that?

In this article, I explain

- What the TSP is and what the F Fund invests in

- How the F Fund can help you achieve a balanced TSP portfolio

- How much money the F Fund has made in the past (and)

- Why the F Fund might have a difficult road ahead

Table of Contents

- What is the Thrift Savings Plan (TSP)?

- What does the TSP F Fund invest in?

- TSP F Fund Returns and Risks

- Historical returns from the F Fund

- How to use the F Fund as part of your Investment Strategy

- Summary- Don’t forget about the F Fund

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the Thrift Savings Plan (TSP)?

Government employees can participate a defined contribution plan similar to the 401(k) called the Thrift Savings Plan, or TSP.

The IRS treats the TSP similar to a 401(k). Federal employees who want to max out their TSP can contribute a maximum of $20,500 ($788 per pay period) to the TSP each year.

The government designed the TSP to be easy enough for the average employee to manage and the TSP has an extremely low service fee (0.06% for the F Fund).

Federal employees can choose between a traditional and a Roth TSP.

Understanding the 5 TSP Funds

The TSP does not have mutual funds. Instead, it has trust funds managed by the comptroller of the currency. As a TSP participant, you can invest in one of 5 individual funds; 3 stock funds:

- The C Fund (Common Stock Index Fund)

- The S Fund (Small Cap Stock Index Fund)

- The I Fund (International Stock Index Fund)

And 2 TSP bond funds

- The G Fund (Government Securities Investment Fund)

- The F Fund (Fixed Income Index Investment Fund)

In addition to these funds, TSP participants can contribute to Lifecycle Funds. Lifecycle Funds are comprised of the 5 individual funds whose ratio depends upon the target date.

What does the TSP F Fund invest in?

The F Fund is a bond fund that invests in a broad market of investment grade bonds (fixed income securities). This includes short-term government securities, and high quality corporate bonds.

The F Fund follows the Bloomberg Barclays U.S. Aggregate Bond Index which contains nearly 12,000 notes and bonds including U.S. Treasury notes and other fixed income investments.

Because the Index contains so many securities, the Federal Retirement Thrift Investment Board cannot invest in all of the securities in the index. Instead, they invest the funds for the F Fund in an index funds run by BlackRock Institutional Trust Company, N.A., and State Street Global Advisors Trust Company. (Check out the TSP F Fund Fact Sheet for more information).

What mutual funds are similar to the F Fund?

The Vanguard Total Bond Index Fund (VBTLX) is one of the largest mutual funds that tracks the same index as the F Fund. (VBTLX requires a minimum investment of $3,000). It is also offered as an exchange traded fund with ticker symbol BND.

TSP F Fund Returns and Risks

F Fund rates of return are comprised of

- Interest (coupon) payments

- Investment returns from price fluctuations in the bonds

Understanding interest rate risk

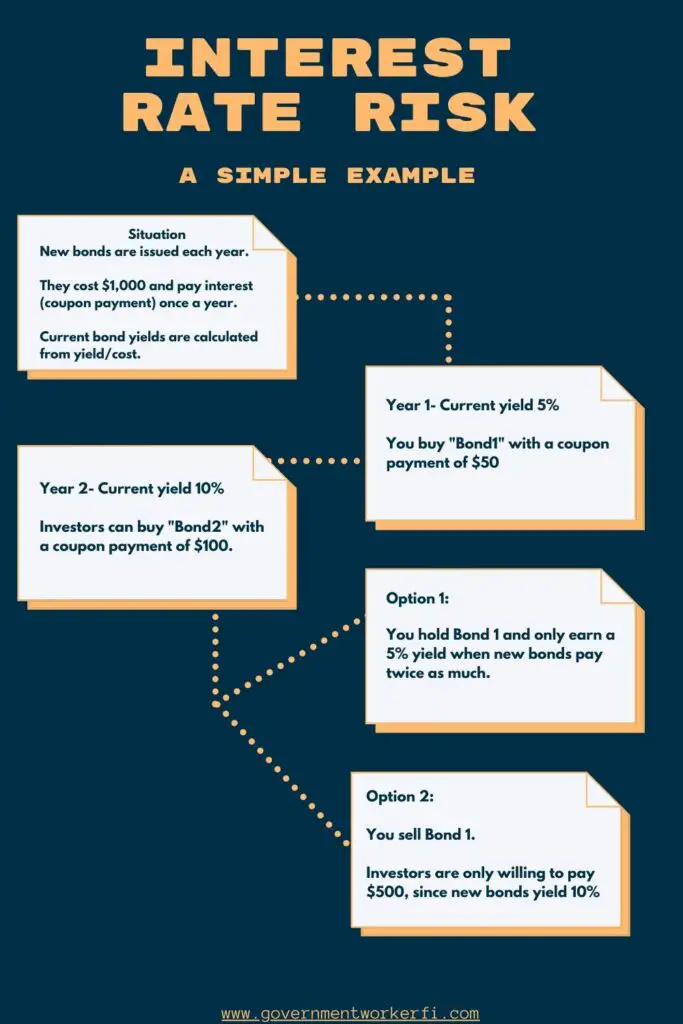

Bond market returns depend upon the interest rates.

When the prevailing interest rates fall, bond prices go up. The bonds are more valuable because new bonds pay less interest. In contrast, as interest rates rise, bond prices fall. This is called interest rate risk.

I know this is confusing to understand, so I made this graphic.

While adding bonds to your investment mix can help you satisfy your investment objectives, it is important to understand that even bonds have investment risks.

Historical returns from the F Fund

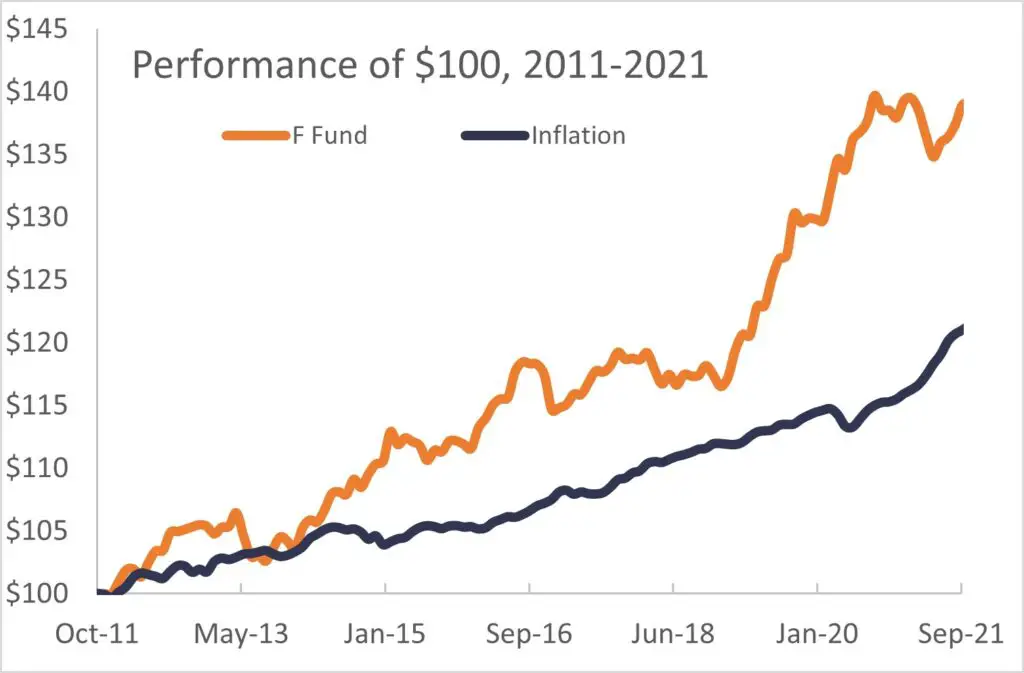

Over the past 10 years, the TSP F Fund has outpaced inflation. Given that the primary purpose of the F Fund is capital preservation, it achieved this goal.

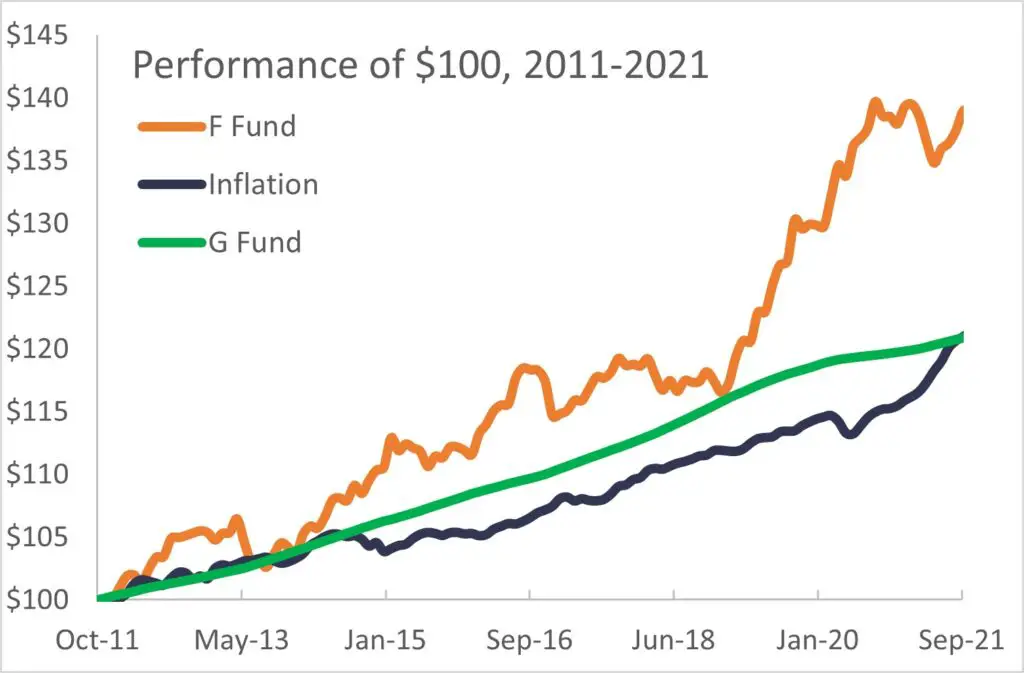

Comparing the F Fund and G Fund

Both the F Fund and the G Fund can help you with capital preservation (i.e. keeping the money you’ve saved). However, it’s important to understand how these can be part of your investment plan.

The G Fund invest in is unique among bond funds because it has a guaranteed positive return. It is immune from interest rate risk.

“The G Fund rate calculation results in a long-term rate being earned on short-term securities. Because long-term interest rates are generally higher than short-term rates, G Fund securities usually earn a higher rate of return than do short-term marketable Treasury securities.”

The F Fund also invests in short and medium term investments. While the F Fund can lose value, it also has a higher upside and can earn more over the long run.

Long-term returns of the F Fund are higher than the G Fund.

Rate of Return for the F Fund and the C Fund

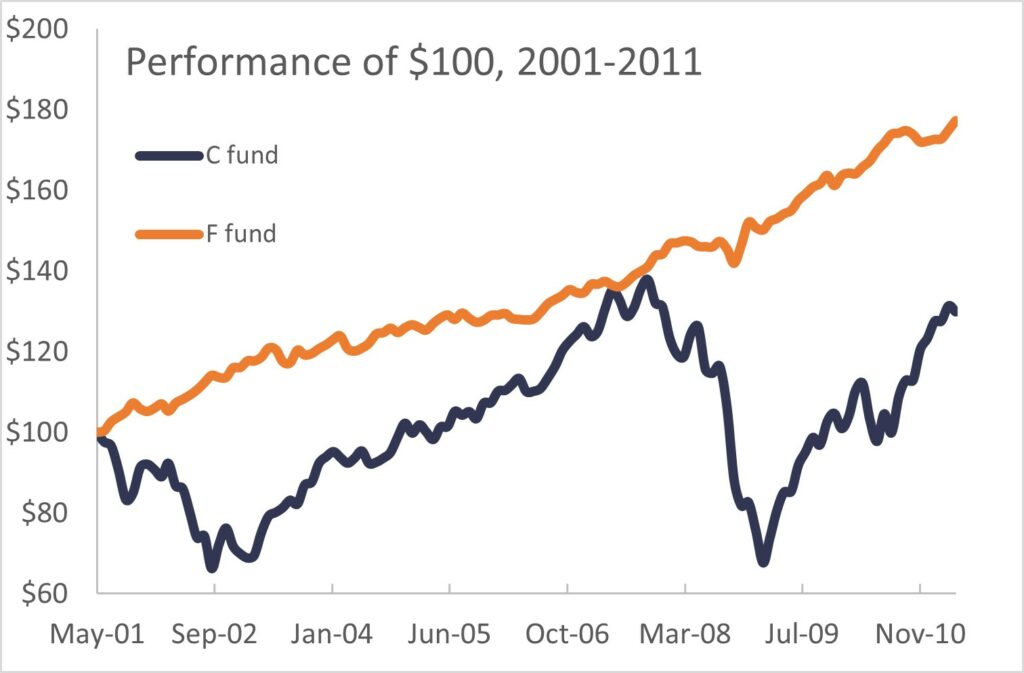

Over the long run, the C Fund has outperformed the F Fund. However, there have been many periods where the F Fund has performed better than the C Fund.

The early 2000’s were a difficult period for US Equities. During this decade The F Fund outperformed the C Fund.

How to use the F Fund as part of your Investment Strategy

The F Fund can help you add stable investments to your retirement portfolio to meet your investment goals.

Stabilizing your portfolio

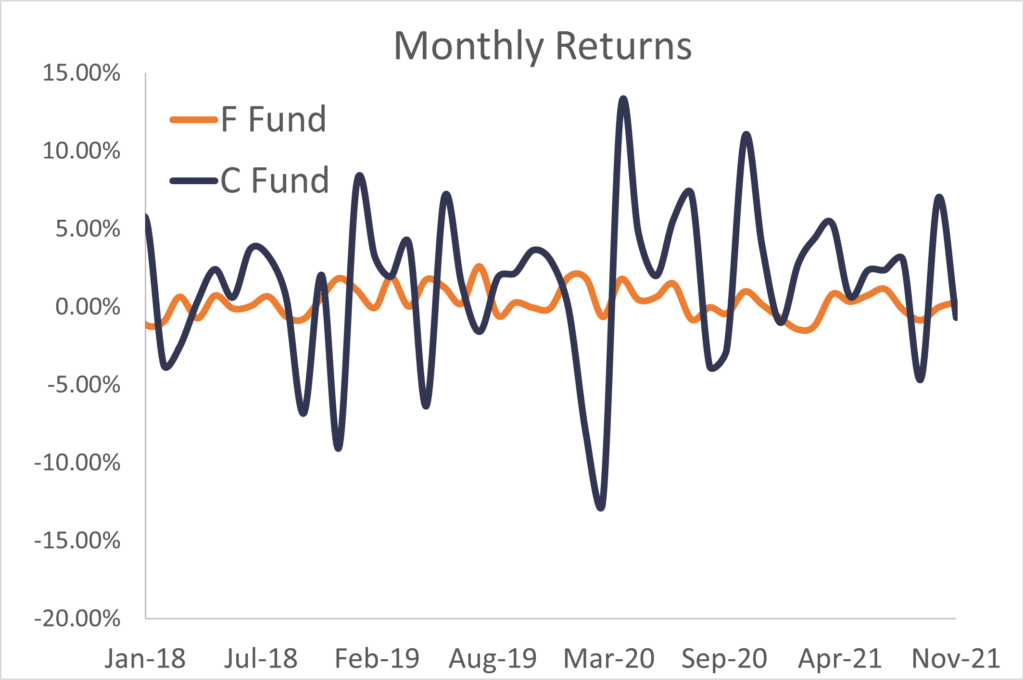

When you look at the C and F Fund returns, two things become clear:

- The F Fund has more stable returns. (Lower highs and higher lows)

- The F Fund moves out of phase with the C Fund. (That is, the F Fund doesn’t always go down when the C Fund does).

By combining the C and F funds within a portfolio, you can smooth out swings in the value of your portfolio. For example, The F Fund not only maintained value, but increased slightly during the stock market crash in March 2020. Participants holding the F Fund were partially shielded from this crash.

Reducing portfolio fluctuations is especially important in retirement, when you might not want to withdrawal money after your portfolio has lost value.

Why aren’t more people using the F Fund?

Despite the fact that the F Fund can help you obtain broad market diversification, not many federal government employees use it.

According to the Thrift Savings Plan board, the F Fund is the least popular fund. While over 26.5% of investors’ money is in the G Fund, only 3.3% of the money within the TSP is invested in the F Fund. (This is the smallest amount of any of the core funds).

If bonds are part of your asset allocation, you may want to consider holding some of your bond portfolio in the F Fund, even if you’re not an aggressive investor.

The bonds in the F Fund can help you beat inflation, which often is not the case for a short-term U.S. treasury security (G Fund).

Ultimately your time horizon and plans for other retirement dollars will affect the amount of risk you are willing to take in your TSP allocation.

Why the F Fund may struggle in the near future

Despite the fact that the F Fund can help you gain bond exposure that can beat inflation, the current environment means that the near-term future of the F Fund is rough.

The Federal Reserve forced the federal funds rates to near zero. While bonds yield more than the federal funds rate, it means that yields cannot reasonably go much lower.

Remember our graphic about interest rate risk? When interest rates rise, bond prices go down. In our current environment:

- Interest rates can only go up, which means that the bonds held within the F Fund will be worth less.

- Interest rates are at historical lows, so the coupon payments/dividends within the F Fund are small.

Note, I cannot predict the future. Perhaps something will happen that causes the F Fund to go on a giant run. I am also not a financial advisor and I am certainly not your financial advisor. Please do not make a portfolio change based solely upon something you read on a blog, no matter how good the blog is. Get Gov Worker’s top 4 tips for federal employees!

Summary- Don’t forget about the F Fund

The F Fund is a bond fun that can have a higher return than the G Fund. While conservative investors may favor the G Fund, the F Fund can help U.S. Government employees outpace inflation in retirement.

Enjoy the article? Check out more posts on the TSP in my TSP School series.

Have questions or comments? You can post them in my Facebook group for federal employees.