This post isn’t just some general platitudes about how child care centers are great for your child’s increasing social interaction skills, communication skills, or math skills.

Yes. High-quality daycare can lead to stronger reading skills and aid in social development.

But let’s be real for a minute. Daycare also costs a tiny fortune.

And is it really worth the massive cost? We live in a country where parents have to fend for themselves with little-to-no financial assistance for raising young children.

Here are my unfiltered thoughts as a dad of 3 who just finished 13 years of paying to have children in daycare.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Let’s get real- what parenting is really like

- Are the benefits of the daycare worth the cost?

- Summary- daycare has benefits for both parents and children

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Let’s get real- what parenting is really like

I love my kids. They are well behaved. We get complimented all the time about what a “nice family” we have.

But honestly, there are sometimes that parenting can be a soul-sucking nightmare.

Perfectly choregraphed family photos seem like a fake candy-coating over the chaos that is a family of five.

There are many times I feel trapped in the house with “little emperors”. They run around, make insane demands, and then hurt themselves or others when I say “no”.

The biggest benefit of daycare is that it lets me be myself again

As much as I want to be a super kind, compassionate Dad, on the worst days, parenting makes me retreat into a protective shell when I’m around the kids. I’m just trying to survive.

It takes so much energy just to keep the kids safe, fed, and clothed that I don’t have time to work on “cognitive development” with my 2-year old.

And sure, some days we have amazing adventures together. But other days, we’re just coexisting in the same house.

Raising kids is a full time job. And being a dad is a big part of who I am. But I’m also a scientist. And a blogger. And a husband.

When I’m “all-in” on parenting, I am not honoring those other parts of my identity. I end up missing them. If we didn’t have daycare, there is no way I wouldn’t be resentful of giving up those parts of my identity.

This is doubly important for single parents. If daycare is one of my few chances to exercise my adult identity with a partner, I can’t imagine how much more a single parent needs that break.

Daycare makes me a better parent

Ironically, daycare makes me a better parent.

For some reason, America seems hell-bent on holding the stay-at-home parent as the paragon of raising the perfect child. They talk about things like “passing along your values” and spending “quality time” with your infant.

Does a 3-month old even know what values are? My 13-year old seems to know what our family values are, but I’m not really sure our younger children do.

I’ve been able to teach my children about our values because I’m able to pay attention to them more fully after they’ve gone to daycare.

While I’m sure whoever said, “absence makes the heart grow fonder” was writing about romantic love, it’s also true for fatherly love. I can’t think about how many times I’ve remarked to my wife that, “we have good kids… when they are asleep”.

It’s a similar story while I’m at work. When I’m outside of the pressure-cooker that is parenting, I’m able to reflect on all of the reasons I love my kids. That in turn makes me want to put more energy into our relationship when I am with them.

Daycare is an investment in their education

Kids learn a lot between the ages of 1-5.

They learn how to walk, run, climb, and ride bicycles. My daughters grew from barely speaking three words to talking in complete paragraphs during that time. In fact, kids probably learn more between the ages of 1-5 than they do from kindergarten through high school.

Daycare teachers are trained to deal with tiny sociopaths. Most parents are not.

I treat daycare as an investment in their education. Could I teach my children basic self-care skills? Sure. I could. But I don’t have any training in early childhood education.

And given my frenetic life as a parent, I don’t prioritize teaching self-care to my kids. It’s hard to calmly teach proper social etiquette when one of your kids is hitting your other kid with the toy she just stole. Daycare teachers are trained to deal with tiny sociopaths. Most parents are not.

My children entered elementary school with all of the skills they needed thanks to the high-quality childcare they received at their daycare center. While children learn best through play based education, the daycare setting gave them structured times and fostered social skills that prepared them for grade school.

Are the benefits of the daycare worth the cost?

Let’s face it, having kids in daycare is massively expensive, even if there are a lot of benefits for kids (and parents).

But high-quality care doesn’t come cheap. I totaled up our expenses over the past 13 years and we paid well over six-figures for quality child care.

Here’s what our numbers look like.

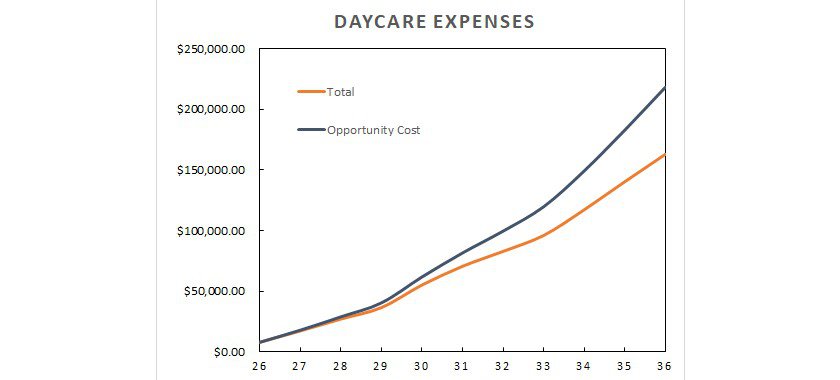

To create the graph, I dug through our tax-returns for the past decade.

Kid1 was born when I was 25 years old, but we didn’t have any childcare expenses to report until the year I turned 26. (Our lives would have been much different if we had the current parental leave for federal employees policy). Way back then, we spent “only” $7,900 on daycare. However, in 2018 we spent close to $23,000. Those numbers are massive– especially when you consider that we were lucky enough to have free childcare 1-day per week during this period.

The opportunity cost of daycare

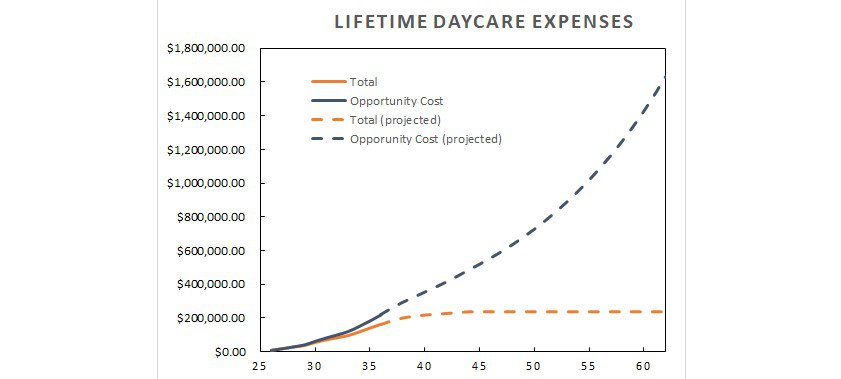

Our lifetime daycare total comes out to roughly $163,000. While that’s a lot of money, that’s not even the worst part. That $163,000 represents money we could have been saving for retirement if we didn’t have to pay for daycare.

To show how this has affected our retirement savings, I also plotted what would have happened if we had invested our daycare money in low-cost index funds. While our daycare costs stopped in 2021 when our youngest started kindergarten, the opportunity cost of having kids keeps getting bigger. For example, if we had invested that money in index funds until we reach a typical retirement age of 62 the money we had spent on daycare could have been worth $1.6 million dollars.

The opportunity costs of no daycare

On the other hand, without formal childcare programs, either my wife or I would have needed to quit our jobs. This would have also had a very large opportunity cost.

Yes. We’re $1.6 million dollars poorer because of daycare. But one of the biggest benefits of daycare was allowing my wife and I to continue growing our careers.

Either way, having kids means you’re going to be poorer. And I’m not complaining. Procreating was something my wife and I consciously chose to do. Unfortunately, not everyone chooses to have a baby dropped into their life. And this is where I wish we were doing more for low-income families. While certain eligible families can receive benefits through head start and other programs, I’m sure that many people slip through the cracks.

Summary- daycare has benefits for both parents and children

While most articles about the benefits of daycare focus on how the daycare environment prepares kids for school, daycare is just as important for the parents. We paid a lot of money for high-quality daycare over the past 13 years. However, doing so allowed my wife and I to grow in our careers while our children had endless opportunities to learn and play in a structured environment.